Bitcoin ETFs have emerged as a groundbreaking development in the financial sector, offering investors a novel way to participate in the cryptocurrency market. This blog post delves into the multifaceted world of Bitcoin ETFs, aiming to provide a comprehensive guide for those interested in understanding and investing in these innovative financial products. From exploring how Bitcoin ETFs work and their benefits to analyzing the key players in the market and investment strategies, this post covers essential aspects to help you make informed decisions. Whether you’re a seasoned investor or new to the world of cryptocurrencies, this guide will equip you with the knowledge needed to navigate the exciting and evolving landscape of Bitcoin ETFs.

Table of Contents

What is a Bitcoin ETF?

At its core, a Bitcoin ETF is a type of exchange-traded fund that tracks the price of Bitcoin, the most popular cryptocurrency. Unlike purchasing Bitcoin directly, where an investor needs a digital wallet and has to deal with the complexities of cryptocurrency exchanges, investing in a Bitcoin ETF allows one to trade on traditional stock exchanges. This simplicity and accessibility make Bitcoin ETFs an attractive option for individuals looking to dive into the crypto market without the typical hurdles associated with direct crypto investments.

The Evolution of Bitcoin ETFs

The concept of a Bitcoin ETF has been in development for several years, evolving alongside the burgeoning cryptocurrency market. The journey began with proposals and rejections from various financial regulatory bodies, primarily due to concerns over market volatility and investor protection. However, as the crypto market matured and regulatory frameworks developed, the first Bitcoin ETFs were eventually launched, marking a significant milestone in the history of both cryptocurrency and traditional finance.

Significance in the Investment World

The introduction of Bitcoin ETFs represents a major leap forward in bridging the gap between conventional finance and the world of cryptocurrencies. For the traditional investor, it offers a familiar and regulated way to gain exposure to Bitcoin’s price movements. For the crypto enthusiast, it signifies a growing acceptance and integration of cryptocurrencies into mainstream finance.

Bitcoin ETFs have opened new doors for investors, providing an alternative way to participate in the dynamic and often volatile world of Bitcoin. They offer a blend of innovation with the stability and oversight of traditional investment methods, making them a noteworthy addition to any investment portfolio.

How Bitcoin ETFs Work

Understanding how Bitcoin ETFs work is crucial for anyone interested in exploring this modern investment avenue. In essence, a Bitcoin ETF is designed to offer a more accessible and regulated path to investing in cryptocurrency, specifically Bitcoin. Let’s break down the mechanism behind Bitcoin ETFs to grasp their functionality and appeal.

The Mechanism of Bitcoin ETFs

A Bitcoin ETF operates much like any other ETF (Exchange-Traded Fund) on the stock market. However, instead of tracking a basket of stocks or a commodity, a Bitcoin ETF tracks the price of Bitcoin. When you invest in a Bitcoin ETF, you’re essentially buying shares in a fund that owns a pool of Bitcoin. The performance of your investment is directly tied to the fluctuation in Bitcoin’s price.

One key aspect that sets Bitcoin ETFs apart from buying Bitcoin directly is that investors do not need to worry about the complexities of handling cryptocurrencies, like managing a digital wallet or dealing with crypto exchanges. Instead, they can buy and sell Bitcoin ETF shares through traditional brokerage accounts, which are familiar and more accessible to the average investor.

Comparison with Direct Bitcoin Investment

The most significant difference between investing in a Bitcoin ETF and buying Bitcoin directly lies in the ownership. When you purchase Bitcoin directly, you own the cryptocurrency and have complete control over your digital wallet. In contrast, with a Bitcoin ETF, you own shares in a fund that, in turn, owns the actual Bitcoin. This indirect exposure means you benefit from Bitcoin’s price movements without needing to manage the cryptocurrency yourself.

How to Invest in a Bitcoin ETF

Investing in Bitcoin ETFs can be a straightforward process, especially for those already familiar with the stock market. For newcomers, understanding the steps involved is key to confidently making this investment. Let’s walk through the process of how to invest in Bitcoin ETFs.

Step-by-Step Guide to Investing in Bitcoin ETFs

- Research and Choose a Bitcoin ETF: Start by researching available Bitcoin ETFs to find one that aligns with your investment goals and risk tolerance. Factors to consider include the ETF’s performance history, management fees, and the provider’s reputation.

- Set Up a Brokerage Account: If you don’t already have one, you’ll need to set up a brokerage account. Choose a broker that offers access to the stock exchanges where Bitcoin ETFs are traded. Consider factors like trading fees, ease of use, and customer support when selecting a broker.

- Fund Your Account: Deposit funds into your brokerage account. This can typically be done via bank transfer, check, or even wire transfer. Ensure you have sufficient funds to cover your investment and any associated trading fees.

- Place an Order: Once your account is funded, you can place an order to buy shares in your chosen Bitcoin ETF. You’ll need to decide on the type of order – such as a market order, limit order, or stop order – based on your investment strategy.

- Monitor Your Investment: After purchasing your Bitcoin ETF shares, monitor your investment as part of your overall portfolio. Keep an eye on Bitcoin market trends, news, and the performance of your ETF to make informed decisions about holding or selling your investment.

Tips for First-Time Investors

- Start Small: If you’re new to Bitcoin or ETFs, consider starting with a small investment to get a feel for the market’s volatility.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Bitcoin ETFs should be part of a diversified investment portfolio.

- Stay Informed: The cryptocurrency market can be volatile. Stay updated with market trends and news to make well-informed decisions.

Top Bitcoin ETFs in January 2024

As of January 2024, several Bitcoin ETFs have made a significant impact in the market. Each offers unique features and strategies catering to various investor needs. Let’s delve into some of the top Bitcoin ETFs currently attracting attention: ProShares Bitcoin Strategy ETF (BITO), VanEck Bitcoin Strategy ETF (XBTF), ProShares Short Bitcoin ETF (BITI), Valkyrie Bitcoin Strategy ETF (BTF), Simplify Bitcoin Strategy PLUS Inc ETF (MAXI), and Global X Blockchain & Bitcoin Strategy ETF (BITS).

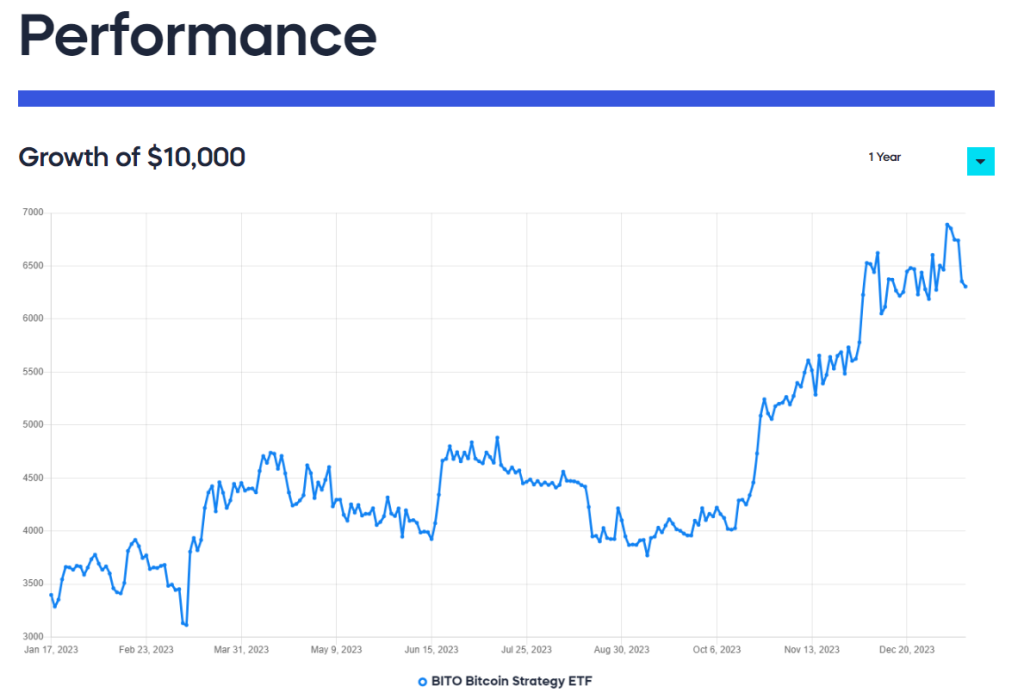

ProShares Bitcoin Strategy ETF (BITO)

- BITO has been a popular choice for investors looking to gain exposure to Bitcoin’s price movements through futures contracts. It’s ideal for those who prefer a regulated investment vehicle without the need to hold the cryptocurrency directly.

VanEck Bitcoin Strategy ETF (XBTF)

- XBTF stands out with its approach of investing in Bitcoin futures contracts. This ETF aims to offer investors a cost-effective way to gain exposure to Bitcoin prices, making it a compelling option for those interested in the futures market.

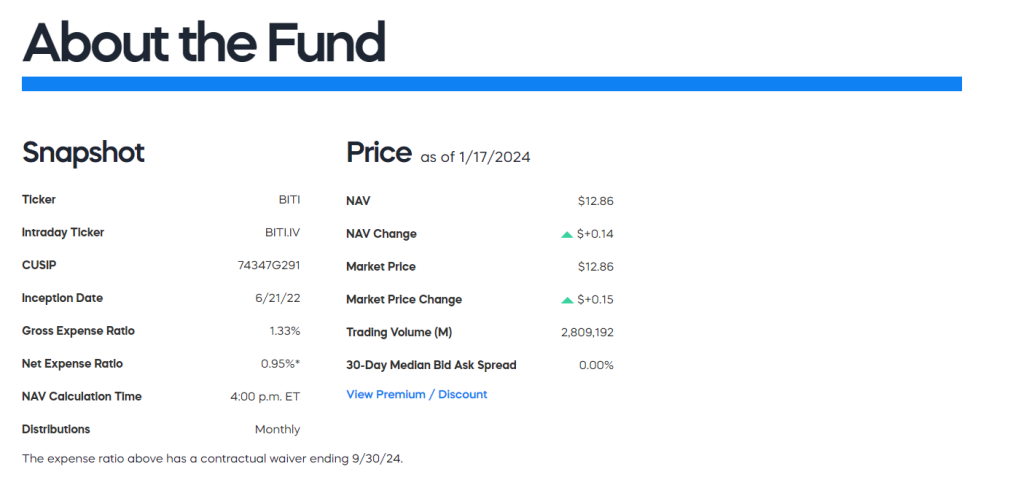

ProShares Short Bitcoin ETF (BITI)

- BITI is notable for being one of the few ETFs allowing investors to bet against Bitcoin’s price. This inverse ETF is an option for those speculating on a decrease in Bitcoin’s value or looking to hedge their cryptocurrency exposure.

Valkyrie Bitcoin Strategy ETF (BTF)

- BTF focuses on investing in Bitcoin futures contracts and is known for its active management strategy. This ETF seeks to optimize returns based on Bitcoin’s market movements, appealing to those who prefer a more hands-on investment approach.

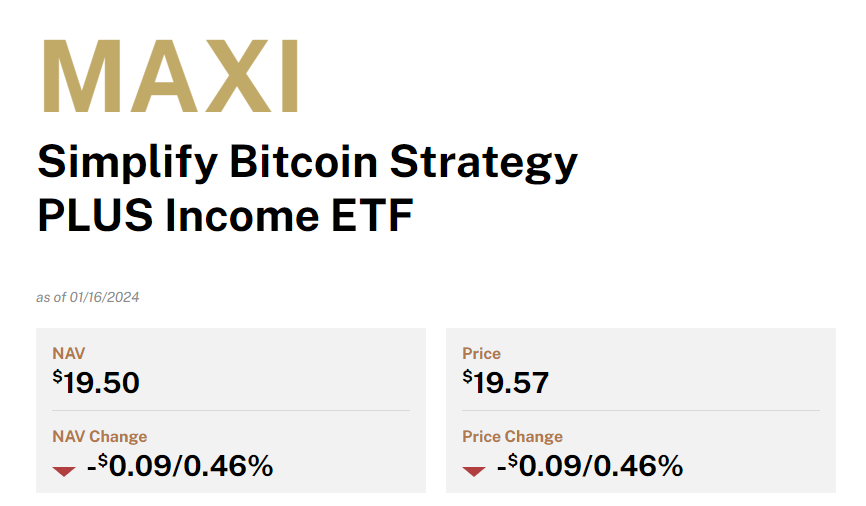

Simplify Bitcoin Strategy PLUS Inc ETF (MAXI)

- MAXI combines Bitcoin-linked derivatives with income-focused assets, offering a unique blend of growth potential from Bitcoin and steady income from the fixed-income component. This strategy might attract investors looking for both growth and income.

Global X Blockchain & Bitcoin Strategy ETF (BITS)

- BITS takes a broader approach by investing in a mix of Bitcoin futures and blockchain technology companies. This ETF is ideal for investors seeking exposure to the broader blockchain ecosystem alongside Bitcoin.

Choosing the Right Bitcoin ETF

When selecting a Bitcoin ETF, consider factors such as investment strategy, risk tolerance, and how the ETF fits with your overall investment goals. Remember, the cryptocurrency market can be volatile, so it’s essential to stay informed and consider diversifying your investments.

Conclusion: Embracing the Future with Bitcoin ETFs

As we conclude our exploration of Bitcoin ETFs, it’s clear that these financial instruments represent a significant evolution in the investment landscape. The emergence of Bitcoin ETFs offers both seasoned and novice investors a unique opportunity to engage with the dynamic world of cryptocurrency in a regulated, familiar, and more accessible format. Echoing the insights from our previous post on [Finding The Best Stock Investing Platforms], Bitcoin ETFs stand as a testament to the evolving nature of the financial markets, offering a unique blend of innovation and accessibility.

The Growing Appeal of Bitcoin ETFs

Bitcoin ETFs have undeniably opened new avenues for investment, merging the innovative potential of cryptocurrencies with the stability and familiarity of traditional stock market trading. Whether it’s through direct Bitcoin exposure, futures contracts, or inverse strategies, these ETFs provide a diverse range of options to suit various investment preferences and risk tolerances.

Key Takeaways

- Accessibility and Ease: Bitcoin ETFs simplify the process of investing in Bitcoin, making it more accessible to a wider audience.

- Diversification: By adding Bitcoin ETFs to your portfolio, you can diversify your investments, potentially reducing risk and enhancing returns.

- Regulated Framework: The regulated nature of ETFs offers a layer of security and legitimacy, which is particularly important in the relatively new and volatile cryptocurrency market.

Looking Ahead

The landscape of Bitcoin ETFs is dynamic and likely to continue evolving. As the market matures and regulatory frameworks develop, we can anticipate more innovative products and strategies. Investors should stay informed and adaptable, ready to embrace new opportunities as they arise.

Final Thoughts

Investing in Bitcoin ETFs can be an exciting venture, but like any investment, it comes with its risks. It’s essential to conduct thorough research, consider your investment goals, and consult with financial advisors if necessary. Remember, investing is a journey, and Bitcoin ETFs are just one of many paths you can explore.

With their growing popularity and potential, Bitcoin ETFs stand as a testament to the ever-evolving world of finance, blending traditional investment practices with the frontier of digital assets. They offer a unique window into the future of investing—a future that is diverse, accessible, and full of possibilities.