Keeping up with your credit score is vital for financial stability and planning. In this blog post, we delve into various tools and services that are essential for monitoring and understanding your credit score. From well-known platforms like Credit Karma, Credit Sesame, and myFICO, to the official AnnualCreditReport.com, we provide an in-depth look at each service. Discover how these resources can help you maintain, monitor, and improve your credit score, empowering you to make informed financial decisions.

Table of Contents

Track and Keep Up with Your Credit Score for Free

To regularly keep up with your credit score, several free tools and services are at your disposal. Platforms such as Credit Karma, Credit Sesame, and myFICO offer cost-free access to your credit scores. Additionally, major credit bureaus like Experian, Equifax, and TransUnion provide free credit score checks on their websites. For more proactive monitoring, consider signing up for credit monitoring services that alert you to changes in your credit report.

Factors Influencing Your Credit Score

Your credit score is shaped by various elements, most of which are part of your credit history. Key factors include:

- Credit History: Older accounts and those with higher limits can positively influence your score.

- Credit Utilization: The ratio of credit used to credit available is crucial.

- Credit Inquiries: Be mindful that credit checks can temporarily lower your score.

- Types of Credit: Diverse credit forms, like installment loans and revolving credit, are assessed differently.

Improving Your Credit Score

Boosting your credit score revolves around personalized strategies, tailored to your unique credit history. However, general tips include:

- Timely Bill Payments: Ensure you pay your bills on time.

- Low Credit Card Balances: Aim to keep your credit card balances relatively low.

- Measured Credit Applications: Avoid opening multiple credit accounts simultaneously.

- Correcting Report Inaccuracies: Dispute any errors in your credit report.

Navigating Credit Karma: Your Guide to Keeping Up with Your Credit Score

In the modern financial world, keeping up with your credit score is essential for making informed decisions. Credit Karma stands out as a popular tool for this purpose. This guide provides an informative overview of how Credit Karma can help you stay on top of your credit score.

Understanding Credit Karma

Credit Karma is a free online service that offers users a way to monitor their credit scores and reports from two major credit bureaus, TransUnion and Equifax. By providing insights into your credit data, Credit Karma enables you to keep up with your credit score efficiently.

Key Features of Credit Karma

- Free Credit Reports and Scores:

- Access to your credit scores from TransUnion and Equifax.

- Regular updates to keep up with any changes in your credit score.

- Credit Monitoring:

- Real-time alerts about significant changes to your credit report.

- Proactive monitoring to help you keep up with your credit score.

- Credit Score Simulator:

- Tools to simulate how certain financial decisions might impact your credit score.

- Insightful for planning and improving your credit health.

- Personalized Recommendations:

- Suggestions for credit cards and loans based on your credit profile.

- Helps in making informed decisions that align with your credit score.

- Educational Resources:

- Articles and tips to help you understand credit and how to manage it.

- Essential for anyone looking to keep up with their credit score knowledge.

How to Use Credit Karma Effectively

- Regular Check-Ins: Regularly log in to Credit Karma to review your credit score and report.

- Alerts Setup: Enable alerts to stay informed about changes in your credit report.

- Analyze Reports: Understand the factors affecting your credit score through detailed reports.

- Use Simulators: Experiment with financial scenarios to see potential impacts on your credit score.

- Follow Recommendations: Consider Credit Karma’s personalized recommendations for financial products.

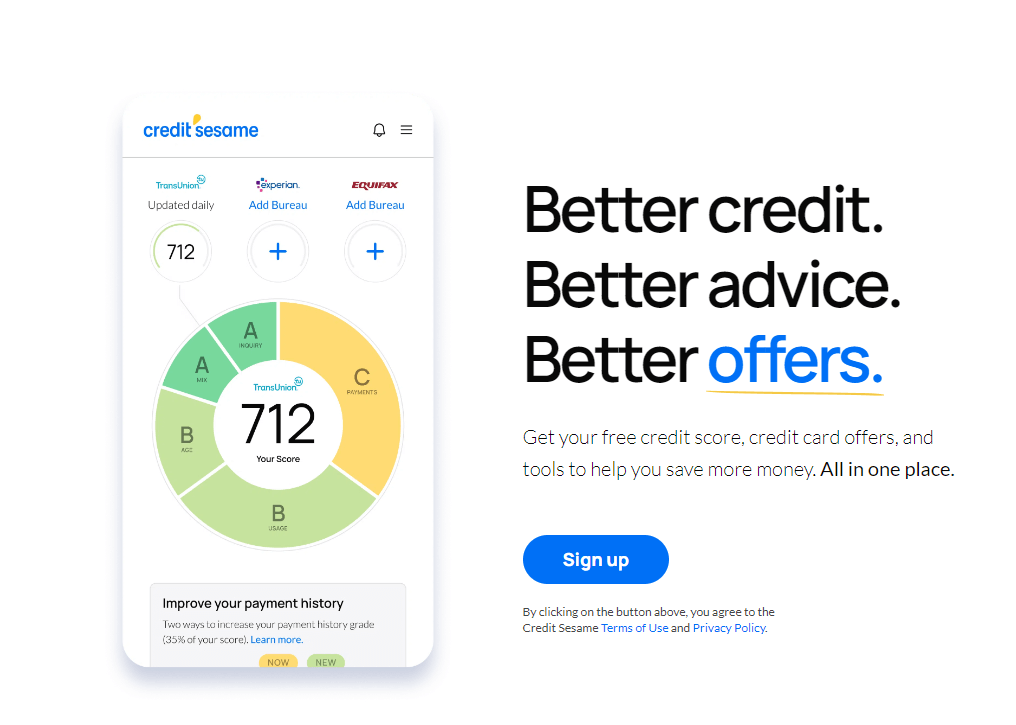

Exploring Credit Sesame: Your Essential Tool to Keep Up with Your Credit Score

Credit Sesame emerges as a key player in this space, offering valuable tools for credit monitoring and management. This article delves into how Credit Sesame can assist you in staying informed and proactive about your credit score.

Overview of Credit Sesame

Credit Sesame is a free online service that provides consumers with easy access to their credit score, credit monitoring, and financial advice. It’s designed to help users keep up with their credit score and make better financial decisions.

Key Features of Credit Sesame

- Free Credit Score Access:

- Obtain your credit score without any charge.

- Regular updates to help you keep up with changes in your credit score.

- Credit Monitoring and Alerts:

- Real-time alerts for any significant alterations in your credit report.

- Continuous monitoring to efficiently keep up with your credit score.

- Personalized Financial Recommendations:

- Tailored suggestions for credit cards, loans, and other financial products.

- Recommendations based on your unique credit profile and score.

- Identity Theft Protection:

- Basic identity theft protection included for free.

- Options for enhanced protection services.

- Debt Analysis and Recommendations:

- Tools to analyze and manage your debt relative to your credit score.

- Guidance on how to optimize your debt for better credit health.

Maximizing Benefits with Credit Sesame

- Regular Monitoring: Frequently check your credit score and report through Credit Sesame.

- Enable Alerts: Set up alerts to stay updated on any changes to your credit status.

- Review Credit Tips: Use the educational resources provided to better understand credit management.

- Consider Recommendations: Look at personalized financial product suggestions to align with your credit score and goals.

- Manage Debt Wisely: Utilize Credit Sesame’s debt analysis tools for effective debt management.

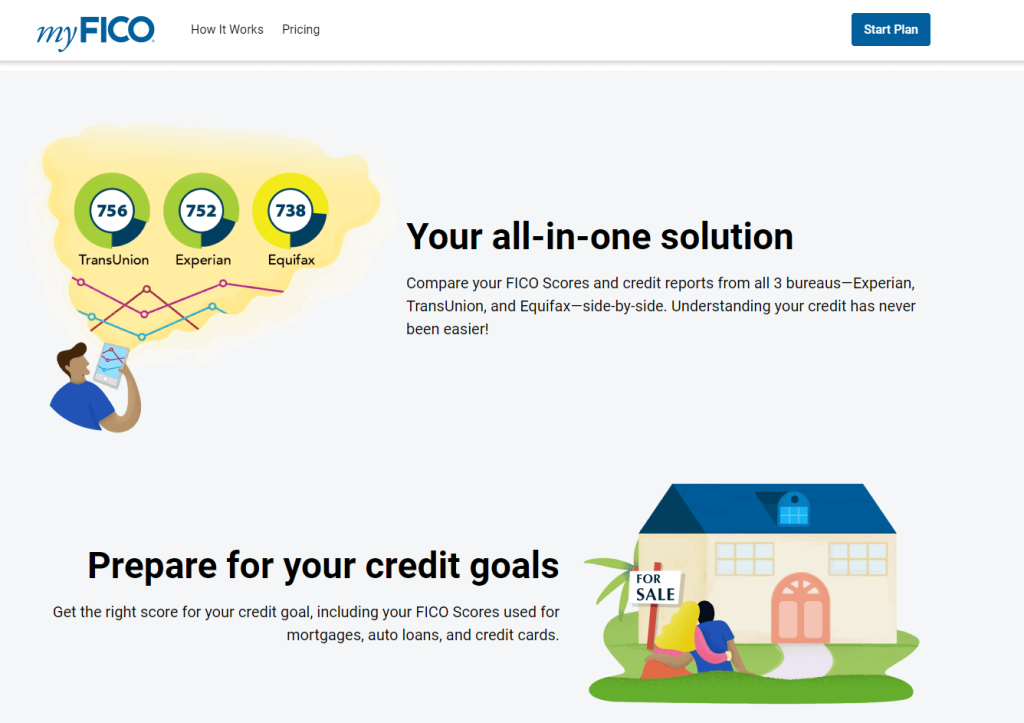

Understanding myFICO: A Comprehensive Tool to Keep Up with Your Credit Score

In the realm of personal finance, keeping up with your credit score is a critical aspect of managing your financial health. myFICO stands out as a leading service in providing detailed credit score information and insights. This article aims to shed light on how myFICO can be a vital tool in your journey to keep up with your credit score.

What is myFICO?

myFICO is the consumer division of FICO (Fair Isaac Corporation), the company behind one of the most widely used credit scoring models. It offers paid services that give users in-depth access to their FICO scores, along with detailed credit reports from all three major credit bureaus.

Key Features of myFICO

- Access to FICO Scores:

- Provides the specific FICO scores used by lenders in credit decisions.

- Helps users keep up with their credit score as seen by creditors.

- Credit Reports from All Three Bureaus:

- Offers detailed reports from Equifax, Experian, and TransUnion.

- Enables comprehensive monitoring of credit history and scores.

- Score Monitoring and Alerts:

- Immediate alerts on important changes in credit reports.

- Essential for users who need to keep up with their credit score actively.

- Identity Theft Monitoring:

- Includes identity theft monitoring and protection services.

- Alerts for potential fraud or identity theft instances.

- Financial Tools and Education:

- Provides calculators and tools to understand credit score impacts.

- Educational resources to help users manage and improve their credit scores.

Making the Most of myFICO

- Regular Score Checks: Regularly review your FICO scores and reports on myFICO.

- Set Up Alerts: Enable customized alerts for new activities on your credit report.

- Analyze Credit Factors: Understand the factors affecting your FICO scores through myFICO’s detailed analysis.

- Stay Informed: Use myFICO’s educational resources to stay informed about credit management and improvement strategies.

- Protect Your Identity: Take advantage of myFICO’s identity monitoring features to safeguard your financial identity.

AnnualCreditReport.com: Your Official Source to Keep Up with Your Credit Score

Maintaining a comprehensive understanding of your credit score is essential in managing your financial health. AnnualCreditReport.com is the official site to help you keep up with your credit score by providing free annual credit reports as mandated by federal law. This article explores how you can use this resource to stay informed about your credit status.

What is AnnualCreditReport.com?

AnnualCreditReport.com is a government-authorized website that allows consumers to request free credit reports every 12 months from each of the three nationwide credit reporting companies: Equifax, Experian, and TransUnion. It’s designed to help individuals keep up with their credit score and monitor their credit history for accuracy.

Key Features of AnnualCreditReport.com

- Free Annual Credit Reports:

- Access to free credit reports from Equifax, Experian, and TransUnion once every year.

- Essential for anyone looking to keep up with their credit score and credit history.

- Comprehensive Credit Information:

- Detailed reports include information on credit accounts, inquiries, and public records.

- Helps in identifying any discrepancies or areas of improvement.

- Secure Access:

- Provides a secure platform for requesting and viewing credit reports.

- Ensures the confidentiality and safety of your personal information.

How to Use AnnualCreditReport.com Effectively

- Annual Checks: Plan to request your credit reports once a year to keep up with your credit score and identify any changes or inaccuracies.

- Review Thoroughly: Carefully review each report for accuracy. Look for any unfamiliar accounts or inquiries that could indicate identity theft or reporting errors.

- Report Discrepancies: If you find errors, report them immediately to the respective credit bureau for investigation.

- Plan Your Requests: You can request all three reports at once or space them out over the year for more frequent monitoring.

- Stay Informed: Use the information in your credit reports to understand your financial standing better and make informed decisions.

Conclusion

regularly keeping up with your credit score is a crucial aspect of managing your financial health. Whether it’s through free services like Credit Karma and Credit Sesame, the detailed insights from myFICO, or the annual reports provided by AnnualCreditReport.com, each platform offers unique tools to help you stay informed and proactive about your credit status. By utilizing these resources, you can gain a clearer understanding of your credit health, spot potential issues early, and take steps to improve your credit score. Remember, a well-maintained credit score not only opens doors to better financial opportunities but also provides peace of mind in your financial journey. Stay vigilant, stay informed, and take control of your credit health today.”

To further enhance your financial knowledge and explore more relevant topics, don’t miss our detailed post on ‘3 Essential Insights into the SAVE IDR Student Loan Repayment Plan‘, where we delve into the latest updates and strategies for managing student loans effectively.