Investing in stocks has always been a popular choice for both traders and investors. However, the key to success lies in identifying the best stock investing platforms that align with your individual needs. Whether you’re a beginner or a seasoned investor, the right platform can significantly influence your investment outcomes. Today’s market offers a plethora of options, making the choice quite daunting.

In your quest to find the top stock investing platforms, it’s crucial to consider several factors: fees, customer service, usability, research tools, available account types, security measures, and integration across mobile and desktop devices.

Table of Contents

Webull: A Top Contender For One Of The Best Stock Investing Platforms

Webull emerges as a standout choice among the best stock investing platforms, offering a range of features and tools tailored to enhance your trading experience. It caters to both experienced investors and those new to the stock market, providing benefits that can elevate your investment strategies and help achieve your financial objectives.

Robinhood: Ideal for Beginners

Robinhood is recognized as one of the best stock investing platforms, particularly for beginners. Its user-friendly interface and low fees, coupled with commission-free trading on stocks, ETFs, and options, make it a great starting point.

Pros: Low fees, intuitive interface, commission-free trading.

Cons: Limited research tools.

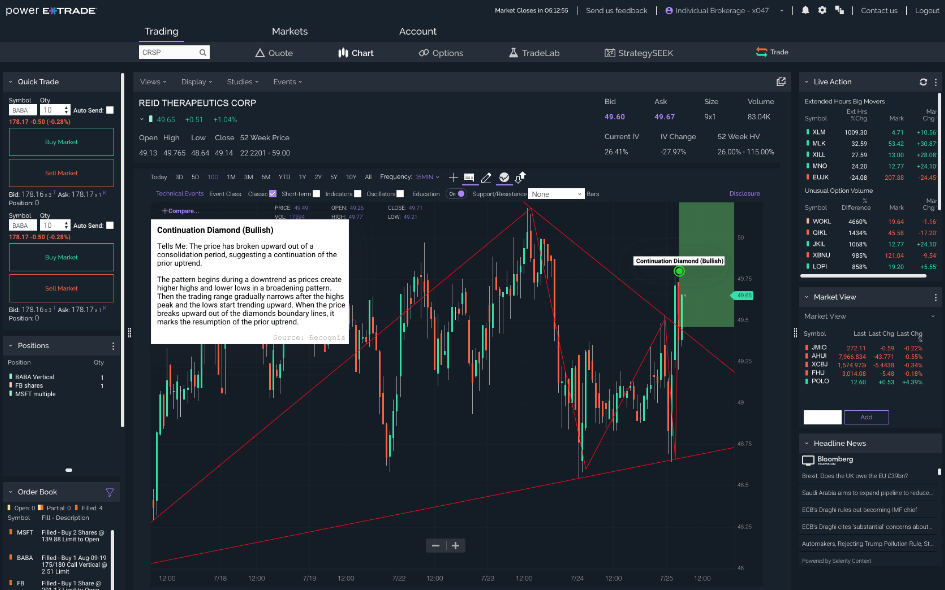

E-Trade: A Haven for Advanced Traders

For those who need advanced research tools and news updates, E-Trade stands out. It’s not just a platform for trading; it also offers banking services like checking accounts and credit cards, making it a versatile choice among the best stock investing platforms.

Pros: High-quality research tools, streaming news.

Cons: Marginally higher fees.

TD Ameritrade: Comprehensive Services for All Levels

TD Ameritrade offers a wide array of products and services, catering to both novice and experienced investors. It’s known for its excellent customer support and trading tools.

Pros: Extensive customer support, great trading tools.

Cons: Higher fees.

Fidelity: Perfect for Long-term Investments

Fidelity is a top choice for long-term investors, providing a broad spectrum of investment options like mutual funds, bonds, ETFs, and more. It’s renowned for its research tools, securing its place among the best stock investing platforms.

Pros: Diverse investment options.

Cons: Limited mobile platform.

Choosing the Right Platform: Tips and Tricks

Selecting from the best stock investing platforms requires careful consideration. Assess your budget, investment experience, and the specific features you need. Whether it’s streaming data, advanced platforms, customer support, or research tools, your choice should align with your investment goals.

Additionally, for those interested in day trading, the right equipment is just as crucial as the right platform. Don’t miss our comprehensive guide on the Best Trading Gear For Day Traders, which provides essential insights into the tools that can maximize your trading efficiency and success.

Final Thoughts

Choosing the best stock investing platform is a critical decision that can shape your market success. Take your time to evaluate your options and pick a platform that best suits your investment style and needs. With the right platform, you’re setting yourself up for a successful journey in stock investing.